Dynamic Mode Decomposition for Financial Trading

Overview

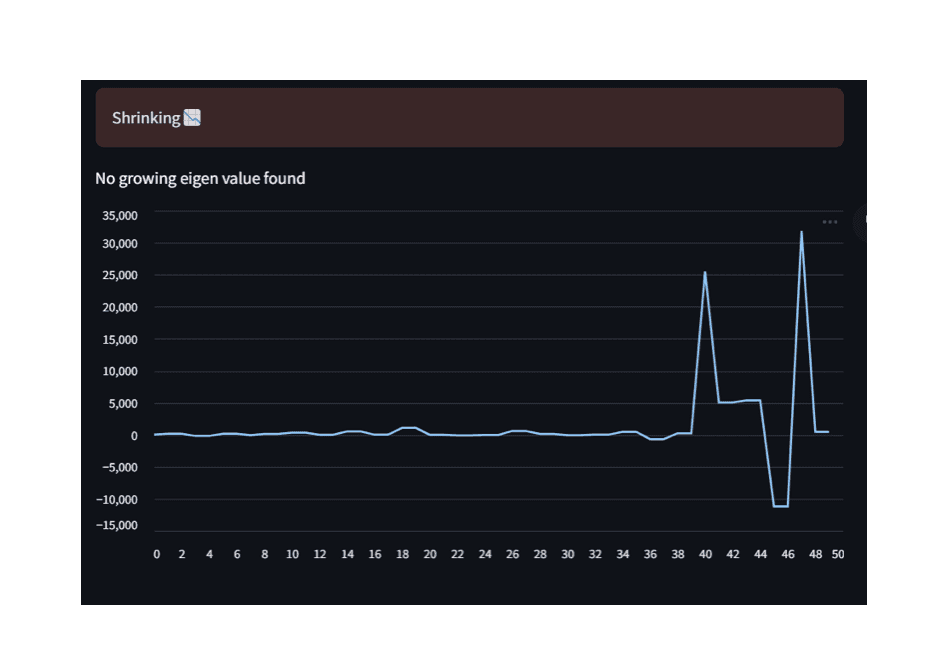

This project applies Dynamic Mode Decomposition (DMD) to financial time series for stock price prediction and trend analysis. By modeling the stock market as a dynamical system, DMD decomposes complex price movements into growth and decay modes, revealing underlying temporal patterns that drive market behavior.

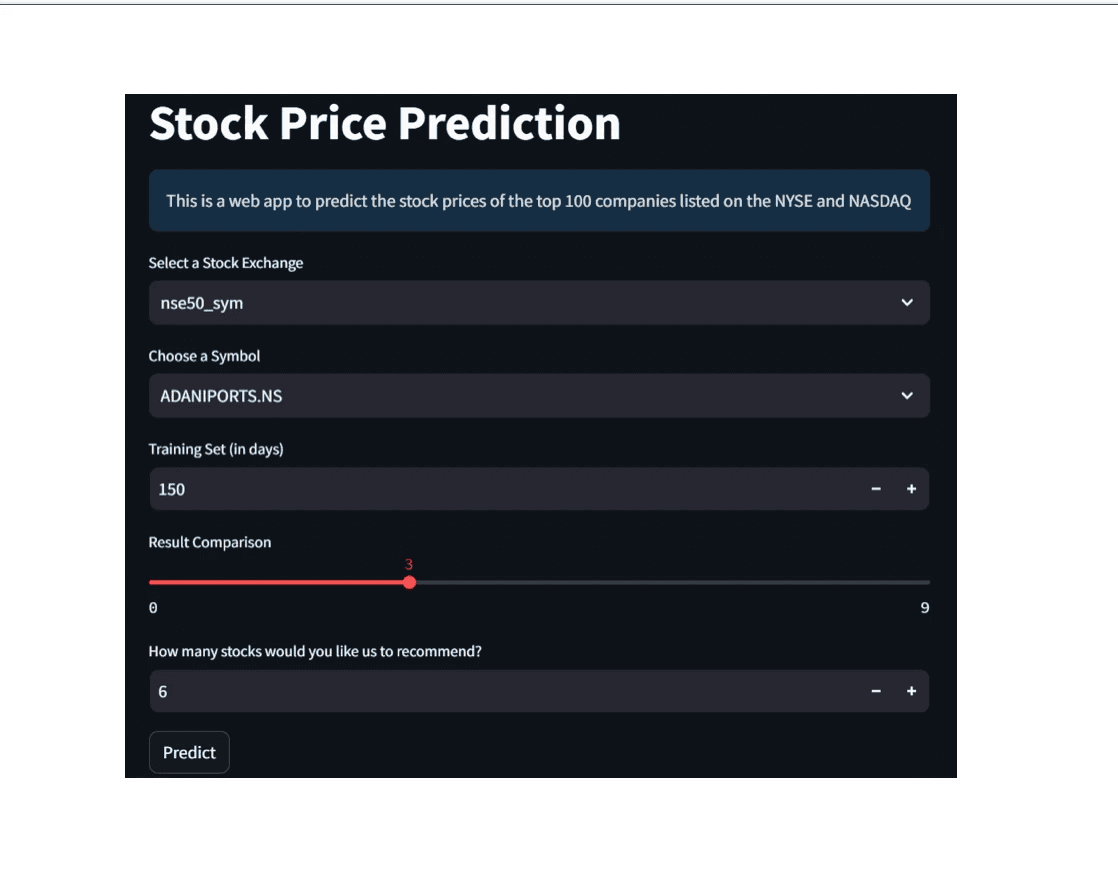

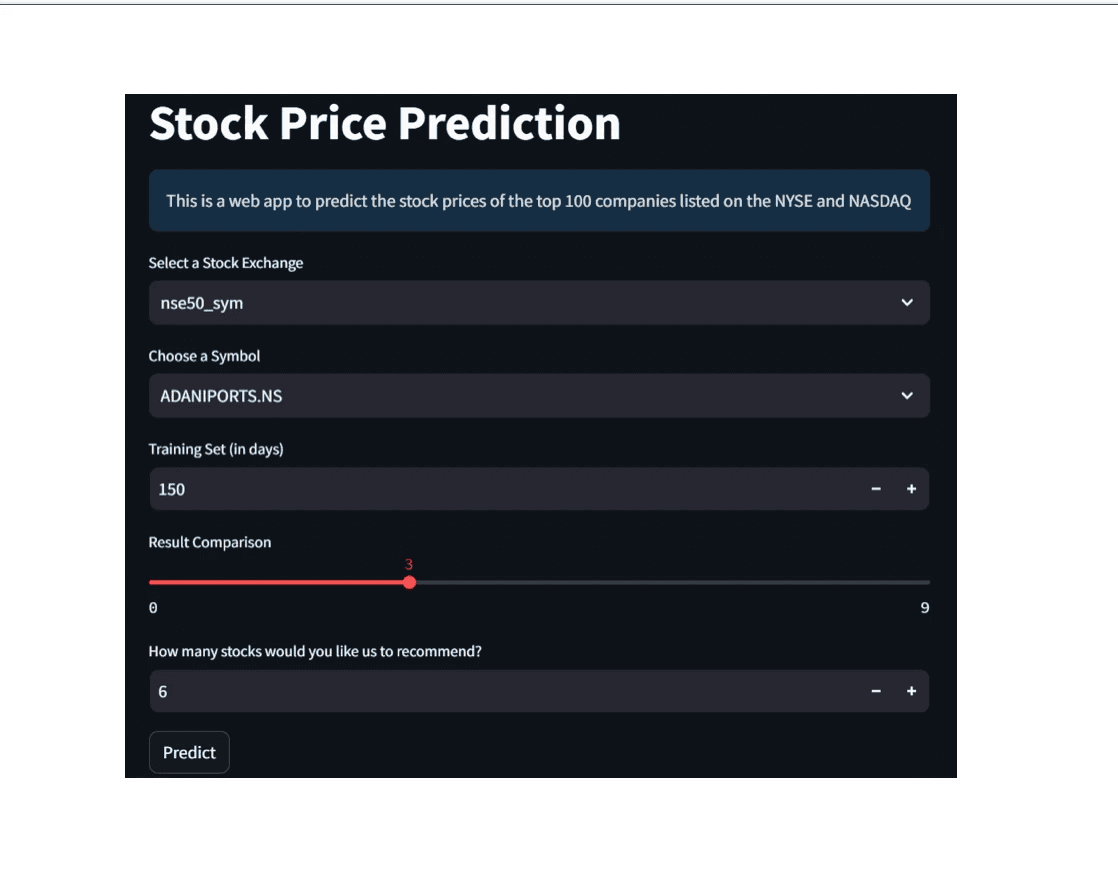

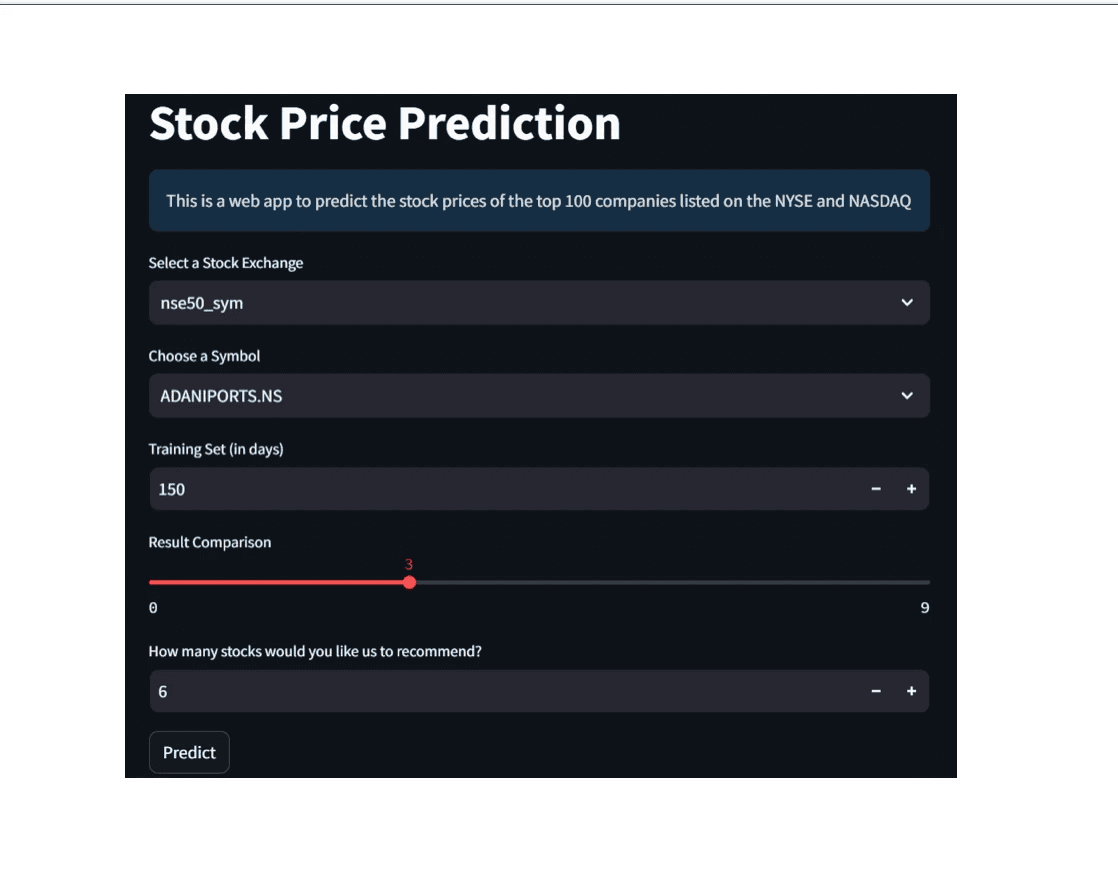

Using NSE500 stock data, the model achieved 1.94% MAPE, showcasing high short-term accuracy. A Streamlit-based GUI was built for visualizing DMD modes, eigenvalue spectra, and automated stock ranking based on dominant growing modes, enabling interpretable and data-driven trading insights.

Tools

Python

Dynamical Systems

Semester

3

Grade

A+

Dynamic Mode Decomposition for Financial Trading

Overview

This project applies Dynamic Mode Decomposition (DMD) to financial time series for stock price prediction and trend analysis. By modeling the stock market as a dynamical system, DMD decomposes complex price movements into growth and decay modes, revealing underlying temporal patterns that drive market behavior.

Using NSE500 stock data, the model achieved 1.94% MAPE, showcasing high short-term accuracy. A Streamlit-based GUI was built for visualizing DMD modes, eigenvalue spectra, and automated stock ranking based on dominant growing modes, enabling interpretable and data-driven trading insights.

Tools

Python

Dynamical Systems

Semester

3

Grade

A+